Every year, millions of people fall victim to fraud and scams. In fact, 2023 was surpassed in total number of scam reports by only one year (2021) this millennium. Criminals continue to come up with more insidious ways to trap and extort us. Sadly, many scammers purposefully target our beloved older ones. One of the best ways to protect ourselves and our loved ones is to be informed. So let’s take a look at some of the top scams of 2023.*

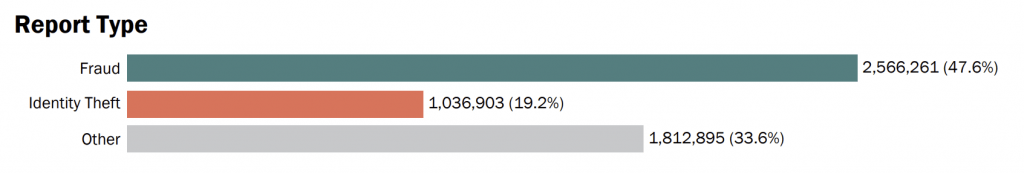

People report being targeted or falling victim to scams to Federal Trade Commission (FTC) or the Consumer Sentinel Network (CSN), who organize the reports into three categories: Fraud, Identity Theft, and Other.

Fraud Scams

Fraud is defined as “wrongful or criminal deception intended to result in financial or personal gain.” This category of crime includes schemes such as fake prizes and sweepstakes, job or investment opportunities, and offering telephone or internet services.

The most common type of fraud in 2023 was Imposter Scams, at a total of 853,935 reports made for a loss of over $2.5 billion. One out of five people targeted by this type of fraud was deceived. This high rate of success stems from the nature of the deception. In imposter scams, the criminal pretends to be a person you trust, perhaps a family member in distress, perhaps technical support or a government agent. They pressure you to urgently send money or share private information by making you fear the consequences of delaying.

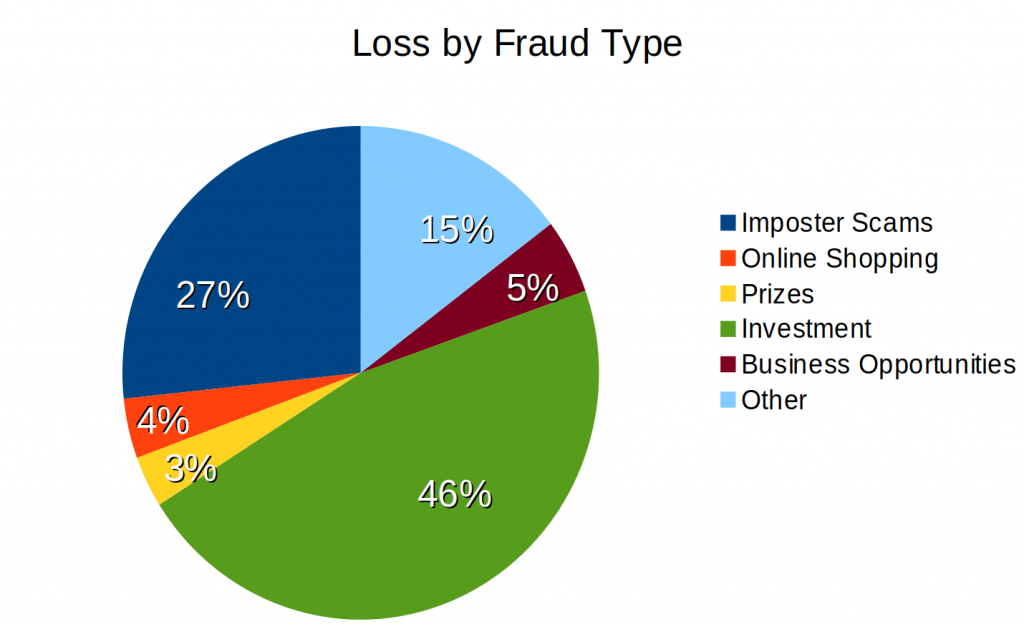

The most expensive type of fraud in 2023 was Investment Scams. At only 5% of the total number of fraud reports, they represent 46% of the money lost. There are two reasons for this. First, investments tend to be expensive, so people are more likely to lose more money with this type of fraud. Across all types of fraud, the average loss per person is around $500; whereas, median investment losses in 2023 were $7,768 per person.

Sadly, the CSN report also indicated that people were also most likely to fall for Investment Scams. Compared to a global 27% of people who lost money to fraud scams, 75% of people who were targeted with an Investment Scam lost money, for a total of $4.6 billion.

Good News for our Seniors

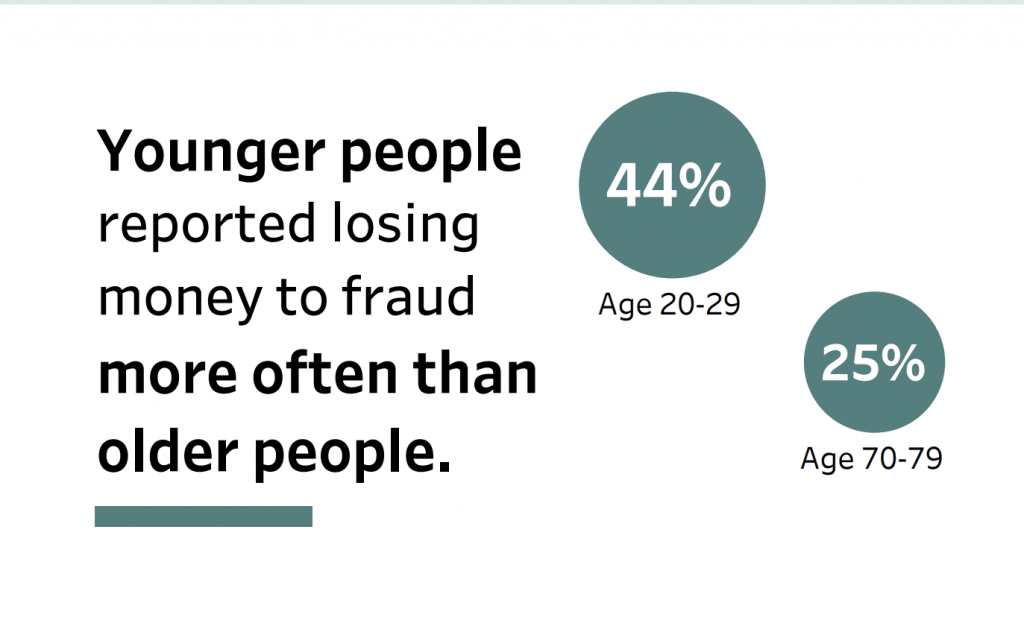

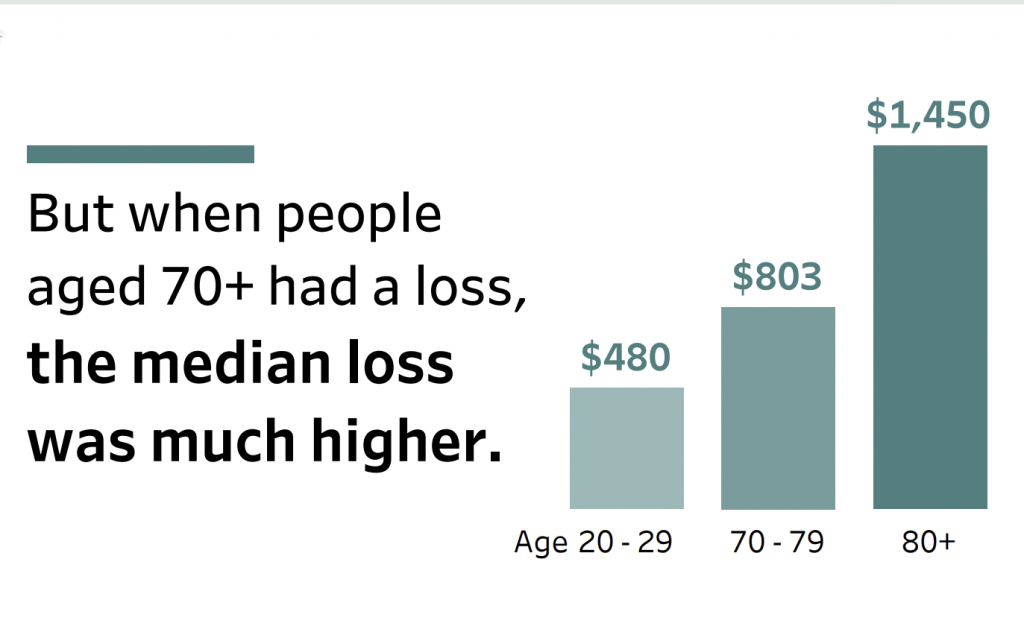

Elderly ones are a favorite target of con artists and cybercriminals, so we worry about them falling victim to these ever-evolving tactics. However, CSN reported some good news for 2023: young people were more likely to lose money to fraud than older people. Excluding minors, people above the age of 70 were tricked by fraud scams less often than any other age group. It’s still important to be on guard, though. The report showed that, when they lost money, older ones were most likely to lose larger amounts.

Other Fraud Stats

Criminals were most likely to contact victims by email (24%) or by phone (20%). On the other hand, people were significantly more likely to lose money when scammed online or on social media (>60%).

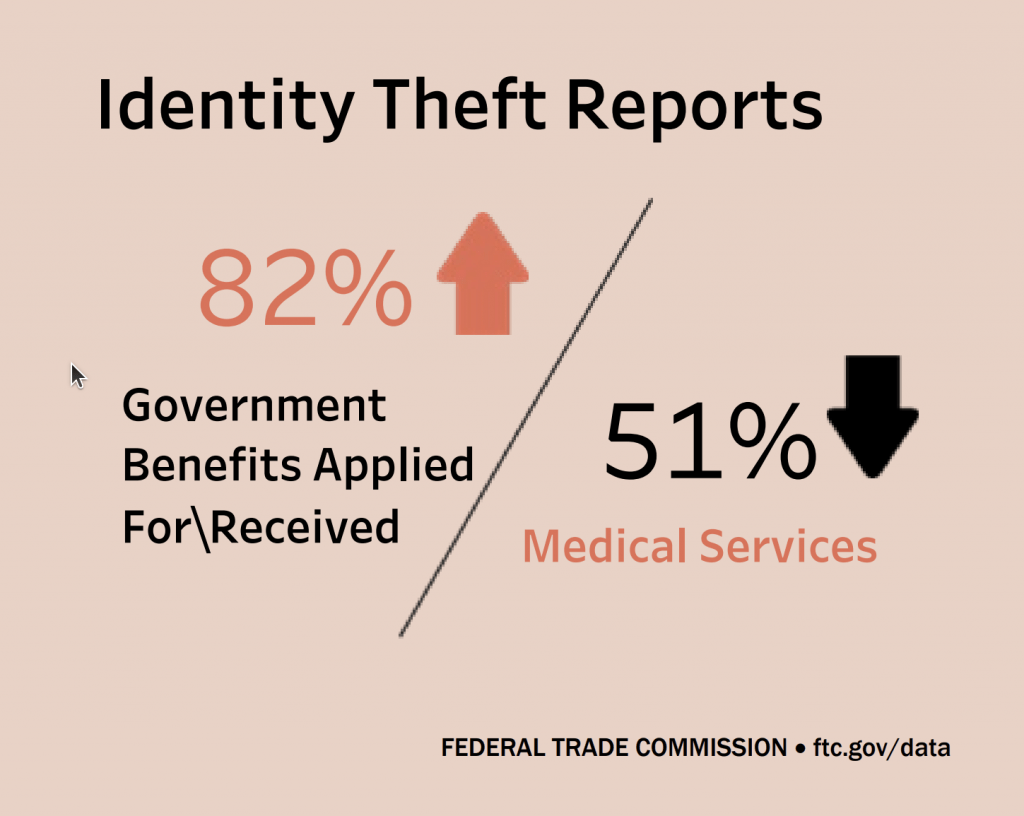

Identity Theft

Identity theft was the top scam of 2023 in California, representing 23% of all reports in the Golden State. Nationwide, over 1 million people reported their identity as stolen. Criminals may then use your personal information, such as credit card or social security number, to steal your money. They may make purchases in your name or sign up for your government benefits. In fact, CSN reported an 82% increase in identity thieves applying for government benefits with the stolen information. The top identity theft scam of 2023 still remains applying for new credit cards with 381,122 reported attempts.

Once an identity has been stolen, it can be very difficult to sort everything out. Many times, money that has been lost is never recovered, and a credit score may take months or years to recover. That is why it is so important to be careful with personal or private information, such as passwords, credit card numbers, and social security numbers.

Other Scams

Criminals can be clever. Year after year, they come up with new tactics to steal our money, at times taking advantage of recent innovations, including AI. Of all the scams reported in 2023, 33% could not be categorized as fraud or identity theft. The Other category also includes real companies that use questionable tactics to extort money from their customers.

With all the danger out there, it’s vital to remain alert to potential threats. Here are some Dos and Don’ts to help avoid being scammed:

How to Protect Yourself from Scams

- DON’T send money just because the sender seems to be a person you know or trust

- DON’T panic because the situation seems urgent

- DON’T send money orders or cryptocurrency to people you don’t know

- DON’T share personal or private information

- DO take the time to confirm the identity of any suspicious phone call or email

- DO ask yourself if the request seems unusual (such as the amount of money or method of sending it)

- DO inform the FTC if you have been scammed

Scammers target everyone, but they especially like to cause problems for our beloved older relatives. Being aware of the threat is the first step to protecting ourselves from it. Make sure you, your friends and family know how to recognize scams and how to react to them.

*As published by Consumer Sentinel Network in their annual report. Some charts are also taken from their report.

One thought on “Top Scams of 2023”